By Fletcher Word

The Truth Editor

LendingTree researchers did an in-depth study of where and how Black Americans fare economically in the 100 largest metropolitan areas. The good news for Washington, DC area residents is that Black families are faring relatively well. Black families in the nation’s capital area see the greatest economic prosperity and top the list of the 100 cities.

The bad news for Toledoans is that Black families here fare the worst economically – dead last.

LendingTree examined the Black households in the 100 largest metro areas and analyzed U.S. Census Bureau 2021 American Community Survey data with five-tear estimates and used five financial metrics to determine where Black Americans are thriving the most and least. Those five metrics were: median household income; the percentage of African American households with more than $100,000 income; the percentage of Black individuals, 25 years and older, with college degrees; the homeownership rate and the unemployment rates among those 16 years and older.

Black families in the Washington area were found to be in the top three of five metrics – education, median income and percentage of households earning more than $100,000.

The median household income in the D.C. area is $85,045 – 18.9 percent higher than the national median household income of $69,021. In addition, 40.5 percent of the Black households earn more than $100,000 and 37.2 percent of Black adults 25 and older have earned a bachelor’s degree or higher. As one would expect, given those numbers, the D.C. area Black residents also have a top-10 ranking in homeownership – 51.3 percent of D.C. area black families own their homes.

Significantly, the nation’s capital has one of the largest Black populations in the United States at 28 percent and one of the highest percentages of Black-owned business at seven percent.

On the other hand, there is nothing but bad news about Toledo in the LendingTree research.

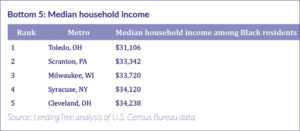

Black households in the Toledo metro area rank near the bottom in four of the five economic metrics. Black Toledoans are last in household income at $31,106 annually; third worst in education with only 14.8 percent of individuals 25 years and older possessing a bachelor’s degree or better; third worst in percentage of households earning $100,000 at 8.6 percent and the fourth worst unemployment rate in the nation at 13.6 percent.

The other cities in the bottom three are Syracuse, New York and Scranton, Pennsylvania.

Ohio Black residents in general did not fare well as Cleveland and Akron are both in the bottom 10 of Black households’ economic prosperity. In fact, the overall rankings for Ohio cities were: Columbus Black residents’ economic prosperity was ranked 63rd out of 100 metro areas; Cincinnati at 77th; Dayton at 85th; Akron at 93rd ; Cleveland at 97th and Toledo at 100th.

Ohio Black residents in general did not fare well as Cleveland and Akron are both in the bottom 10 of Black households’ economic prosperity. In fact, the overall rankings for Ohio cities were: Columbus Black residents’ economic prosperity was ranked 63rd out of 100 metro areas; Cincinnati at 77th; Dayton at 85th; Akron at 93rd ; Cleveland at 97th and Toledo at 100th.

At the top of the list, following Washington, D.C. were Black residents in Austin, TX in second place and those in Provo, UT in third place.

In the various five categories, San Jose and Oxnard, CA, stand out with the highest median incomes for Black households at $85,979 and $83,873 respectively, compared to the overall national median of $69,021.

The top five homeownership rates are all Southern cities – Palm Bay, FL; Charleston, SC; Baton Rouge, LA; Jackson, MS and Augusta, GA. The homeownership rates for Black families in those areas ranges from 62.4 to 52.8 percent.

The cities with the lowest unemployment rates are Provo, UT, Ogden, UT; Deltona, FL; Madison, WI and Palm Bay, FL.

Notably the most distressed economically-distressed cities for Black Americans form a cluster in mainly the upper Midwest from Milwaukee to the western counties of Pennsylvania and New York state. The most prosperous cities are on the coasts and in Sunbelt areas such as Texas.

However, the picture is nowhere rosy. Even in the cities where Black Americans fare relatively well, the LendingTree study notes that Black citizens there encounter the same issues as in less well-off cities.

The reasons for that overall lack of prosperity are part of the American historical practices and policies. Recent studies have found that the average household wealth of White families is eight to 10 times more than that of Black Americans.

Black families, in particular, experience lower homeownership rates; less generational wealth and lower educational achievement than their white counterparts.

Homeownership is a primary path to accumulating generational wealth but Black Americans have been historically stymied from buying property due, in large part, to restrictions placed on banks and real estate developers by the federal government. Such practices began in earnest in 1934 by the Federal Housing Administration. The FHA, well into the 1960s, discouraged the banks from lending to prospective Black families.

Such long-term practices limited homeownership and generational wealth among Black families and less wealth meant that for years Black Americans were less able to be in positions to access quality education, even after the Supreme Court opened up equality in public education for all Americans in 1954.

Even recent years have not brought about any significant closing of the prosperity gap. A previous study by LendingTree in 2020 found that after the Great Recession of 2008-09, the American economy saw a period of recovery and growth. Black Americans, however, while buoyed by that post-recession growth, captured a much smaller share of economic gains between 2013 and 2018 than did Americans in general.

“Add it all up, along with myriad other factors, and it becomes clear that Black Americans face a far windier, rockier and more uncertain path toward prosperity than many other Americans,” said LendingTree chief credit analyst Matt Schulz.

Ed. Note: This article was originally published in The Truth in a September 2023 issue