Mix the racial wealth gap with high costs of living and the burden of student loan debt feels heavier for Black people in some parts of the U.S.

By Bria Overs

Word In Black Press

From coast to coast, Americans are closely watching and dreading the upcoming end to the federal student loan payment pause. Borrowers in some states, however, have more debt than others.

For Black people, the lasting effects of their debt depend on where they live which is often in those same states with higher debts owed per borrower.

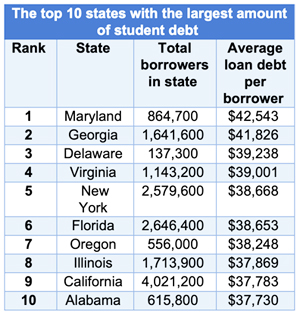

The research, conducted by CreditDonkey, compared all 50 states using recent student debt data from the Federal Reserve Bank of New York to discover which states had the highest proportion of student debt per borrower. Credit: CreditDonkey

A new CreditDonkey analysis comparing all 50 U.S. states found the top 10 with the highest student debt per borrower. Those top states, in order, are Maryland, Georgia, Delaware, Virginia, New York, Florida, Oregon, Illinois, California, and Alabama.

Data from Pew Research Center adds another layer to this picture. At least eight of these states rank highly among those with the largest Black populations. Combined with the reality that Black students hold more student loan debt than any other racial or ethnic group, with a median of $30,000 owed.

Saddled with such a large amount of debt, many attempt to find their footing in places with higher costs of living.

For example, over three million Black people call the New York City metro area home — the nation’s largest Black population. Fortuna Admissions co-founder Caroline Diarte Edwards says places like this are hubs for career opportunities.

“The big cities offer unmatched career opportunities, leading many Black Americans to take risks and move to them despite the high student loan debt and cost of living,” Edwards says.

Indeed, paying rent on a market-rate apartment in a major city, on top of hefty student loan payments, is a sobering prospect.

“High housing costs directly contribute to high levels of student loan debt. Inexpensive and safe housing is very difficult to find in the most expensive cities, leading many students to take out costly loans to cover their high living costs. This exacerbates the existing financial inequality between Black and white communities and prevents Black students from building stability and upward mobility.”

CAROLINE DIARTE EDWARDS, CO-FOUNDER OF FORTUNA ADMISSIONS

The analysis revealed that Maryland — which is 29.5 percent Black — has the highest average loan debt per borrower at $42,543, with 864,000 total borrowers. Georgia — 31 percent Black — is in a close second with $41,826 per borrower and 1.6 million total borrowers.

For those who borrow, this debt creeps into other aspects of their lives. But, it uniquely impacts Black people and communities — especially in the long term.

One of those long-term effects is the inability to become a homeowner. Homeownership is a gateway to generational wealth.

“Homeownership is more difficult to realize for student loan borrowers,” Jennifer Ledwith, a Certified Financial Planner and the founder of Scholar Ready, tells Word In Black. Scholar Ready helps high school students prepare for the ACT and SAT exams, and assists with college admission and scholarship essays.

“When potential homebuyers seek mortgages, lenders consider the borrower’s debt-to-income ratio. The greater the amount of student loan debt, the higher the debt-to-income ratio, and the less that people can borrow.”

JENNIFER LEDWITH, CERTIFIED FINANCIAL PLANNER AND FOUNDER OF SCHOLAR READY

Student loan payments can be a large chunk of borrowers’ budgets, making it difficult to save for a downpayment and other life experiences.

Ledwith says student debt also affects Black families’ ability to invest academically in their children’s education and communities.

“Student loan expenses prevent African American parents from having the discretionary income required to supplement their children’s education,” she says.

Full participation in the cultural and civic life of a community is tougher too, with student loan debt. Ledwith says that’s because if money is going to student loan servicers, they have less for community organizations like schools, museums, hospitals, art organizations, and churches.

“For African-Americans’ voices to be heard, they must participate,” Ledwith says. “Often, participation requires a financial commitment that student loan payments make impossible.”