Special to The Truth

Vice President Kamala Harris Announces Release of Plan During White House Event with Secretary Marcia L. Fudge, White House Domestic Policy Advisor Susan Rice, and Americans Impacted by Bias in the Appraisal Process

On June 1, 2021 – the centennial of the Tulsa Race Massacre – President Biden announced the creation of the Interagency Task Force on Property Appraisal and Valuation Equity (PAVE) to develop a transformative set of actions to root out racial and ethnic bias in home valuations.

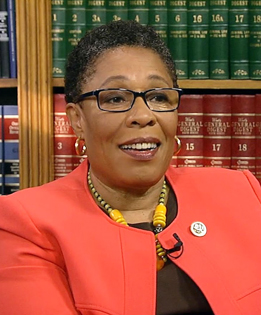

This week, the Task Force is releasing the PAVE Action Plan which, when enacted, represents the most wide-ranging set of reforms ever put forward to advance equity in the home appraisal process, said Vice President Kamala Harris. The Task Force is co-chaired by U.S. Department of Housing and Urban Development Secretary Marcia L. Fudge and Domestic Policy Advisor Susan Rice.

A home appraisal is a critical element of the homebuying and lending process, intended to provide an independent, fair, and objective estimate of the market value of a property so that lenders can accurately evaluate risk.

Homeownership is the primary contributor to wealth building for Black and brown households and continues to hold promise for building multigenerational wealth and housing stability for households of color. However, bias in home valuations limits the ability of Black and brown families to enjoy the financial returns associated with homeownership, thereby contributing to the already sprawling racial wealth gap. Today, the median white family holds eight times the wealth of the typical Black family and five times the wealth of the typical Latino family. According to a recent study (http://racialwealthaudit.org/downloads/RacialWealthGap.pdf), eliminating racial disparities in the amount of wealth families gain from owning a home would narrow the wealth gap by an additional 16 percent between Black and white households and by an additional 41 percent between Latino and white households.

Just since the Task Force was launched, there have been numerous reports of Black homeowners receiving higher appraisals only after taking down family photos and having white families represent them in their stead.

New research shows that mis-valuation in communities of color can be widespread. A recent report from Freddie Mac (https://www.freddiemac.com/research/insight/20210920-home-appraisals) found that appraisals for home purchases in majority-Black and majority-Latino neighborhoods were roughly twice as likely to result in a value below the actual contract price (the amount a buyer is willing to pay for the property), compared to appraisals in predominantly white neighborhoods. Similarly, a recent study from Fannie Mae (https://www.fanniemae.com/research-and-insights/publications/appraising-the-appraisal) examining refinance transactions found that white-owned homes are much more likely than Black-owned homes to be appraised at values that exceed algorithmic predictions.

PAVE Action Plan

The Action Plan details a set of commitments and actions, most of which can be taken using existing federal authorities, that will help every American to have a chance to build generational wealth through homeownership. You can read the full action plan at PAVE.HUD.gov.

Member agencies will take the following actions:

* Make the appraisal industry more accountable. The Action Plan lays out steps to enhance oversight and accountability of the appraisal industry, which has long operated in a relatively closed and self-regulated framework and has not been effective at addressing deep-rooted inequities. Specifically, it commits federal agencies to create a legislative proposal to modernize the governance structure of the appraisal industry, and improves coordination and collaboration between federal enforcement agencies to better identify and redress discrimination in appraisals.

* Empower consumers with information and assistance. The Action Plan includes concrete efforts to empower homeowners and homebuyers on effective steps they can take when they receive a valuation that is lower than expected. For example, federal agencies commit to issue guidance and implement new policies to improve the process by which a valuation may be reconsidered.

* Prevent algorithmic bias in home valuation. Federal agencies that regulate mortgage financing commit to including a nondiscrimination quality control standard as part of a forthcoming proposed rule establishing quality control standards on AVMs (Automated Valuation Models). This will ensure AVMs do not rely upon biased data that could replicate past discrimination.

* Cultivate an appraiser profession that is well-trained and looks like the communities it serves. According to the Department of Labor’s Bureau of Labor Statistics, the appraiser/assessor profession is roughly 97 percent white, making it one of the least diverse professions in the country. The Action Plan lays out a series of actions to remove unnecessary educational and experience requirements that make it difficult for underrepresented groups to access the profession and to strengthen anti-bias, fair housing, and fair lending training of existing appraisers.

* Leverage federal data and expertise to inform policy, practice, and research on appraisal bias. The Action Plan proposes the development of an aggregated database of federal appraisal data to better study, understand, and address appraisal bias, complemented by a working group composed of subject matter experts from stakeholder agencies to develop a research agenda on appraisal bias.

The PAVE Task Force has already made significant progress, and its commitment is ongoing. The Task Force identified several additional policy initiatives that may have the potential to make a significant difference in ensuring fair and accurate home valuations for all communities. These policy ideas require in-depth evaluation and research, greater input from stakeholders, and further exploration.

The Task Force is committed to doing this work. As the Task Force transitions into the next phase of its work to advance equity in home appraisals, it will continue seeking opportunities to collaborate with lending institutions, philanthropy groups, academia, civil rights groups, advocates, and industry associations to create a coordinated approach in tackling this issue.

To read the full report and stay up to date on the work of the Task Force, you can visit PAVE.hud.gov.